Which Is The Best Travel Credit Card To Book Cheap Flights

Last Updated on Mar 4th, 2025 by Heena Ganotra, Leave a Comment

Gone are the days when cash used to be the king. Credit cards have slyly taken over the reins of this kingdom and have absolutely no plans of bequeathing the same. This change of power comes as a rescue for frequent travelers who are always on the lookout for ways that can help them put money back in their pockets.

Travel credit cards, thus, prove to be of great help when it comes to booking flights, including cheap flights from USA to India.

So, whether you have a last-minute business meeting or a laid-back homecoming; whether you want to book non-stop flights from USA to India or connecting flights – having fair knowledge of the best credit card for international travel can help you save a lot.

Let’s delve deep into the world of the best credit cards for international travel & domestic travel to exponentially raise your savings on flight tickets.

Table of Contents:

# Best Travel Credit Card For USA to India Flight Bookings# Types Of Top Travel Credit Cards

# Difference Between Co-Branded & General Travel Cards

# When Should You Choose a Co-Branded Travel Card?

# When Should You Choose a General Travel Card?

# Which Travel Credit Card Is Better – Co-Branded or General?

# Best Co-Branded Travel Credit Cards

# Best United Airlines Co-Branded Credit Cards

# Best Delta Airlines Co-Branded Credit Cards

# Best American Airlines Co-Branded Credit Cards

# Miscellaneous Co-Branded Travel Credit Cards

# Things To Consider Before Buying Co-Branded Cards

# Best General Travel Credit Cards

# Wrapping Up

# FAQs

Best Travel Credit Cards 2023 For USA to India Flight Bookings

Before we move on to the list, do you know how many types of travel credit cards there are? Well, if the basics have a shaky foundation, delving deep will account for nothing. Let’s find out the types of best travel cards you can avail of for USA to India flight bookings before jumping the guns.

Types Of Top Travel Credit Cards

When choosing top travel credit cards for India travel, your first decision will dangle between choosing either of these two cards-

- Co-Branded Travel Credit Cards

- General Travel Credit Cards

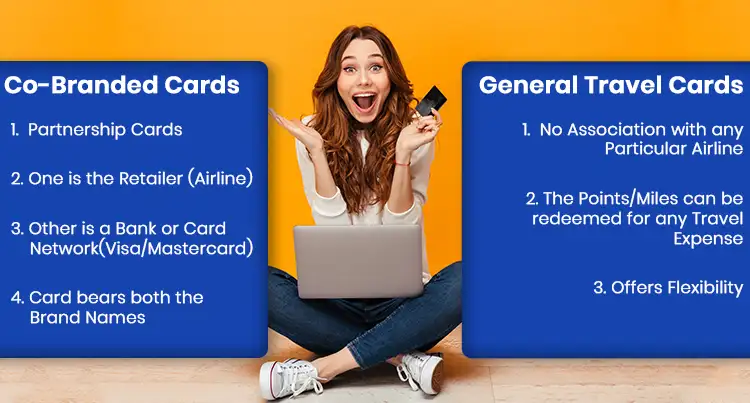

Difference Between Co-Branded & General Travel Cards

Co-branded Credit Cards

These are partnership cards that are a product of two brands. In other words, these cards are sponsored by two entities. One is a retailer – such as an airline or a hotel. The other is a bank or card network – such as Visa, Mastercard, Discover, or American Express (AMEX travel card). The card, therefore, bears the name of both the retailer and the card issuer/ credit card network processor.

Insight: Delta Airlines issues co-branded credit cards through American Express. Likewise, American Airlines issues its cards through Citibank and MasterCard.

Under this, any travel rewards you earn can only be redeemed with that specific airline or hotel you choose to buy the travel credit card of.

General Travel Credit Cards

These are cards that have no association with any particular airline or hotel. These cards bear the logos of the credit card issuer (bank or credit union) and the network (VISA and Mastercard).

Insight: However, because Discover and American Express act as both the issuer and the network, there may be only one logo on the card. Such credit cards can be used anywhere where the credit card network is accepted.

Under this, you can earn and choose to redeem your travel rewards for any travel expense. That’s why it is considered one of the best travel rewards credit cards. You are, in no way, bound by a particular airline or a hotel. You can either earn miles for future flights or redeem points for perks.

When Should You Choose a Co-Branded Travel Card?

If you are loyal to a particular brand and use that same airline to fly every time you book flights, you are a perfect fit for co-branded travel cards. And if you travel more, your card will keep unlocking perks like priority boarding, free upgrades, and other such benefits. For Example: If you always check your bags, you can save up to $50 per round trip.

Tip – Searching for low-cost flights but not sure when flight prices drop? No worries! check out our guide now for easy,budget-friendly flying.

When Should You Choose a General Travel Card?

If you are more inclined towards flying with the cheapest airline rather than earning rewards when you book flights from USA to India, a general credit card will benefit you more. A co-branded card is, thus, the best credit card for airline miles. And if you know how to use your card well, you will end up enjoying more benefits than you can even imagine.

Which Travel Credit Card Is Better – Co-Branded or General?

In order to reduce the expenses on USA to India flight bookings, evaluating which of the two cards is better can be an overwhelming activity. However, it is entirely dependent on your spending habits and preferences. Whatever works for you and syncs well with your lifestyle is the card you should go ahead with.

Remember: There’s no “wrong” travel credit card. Just a better card that matches your goals.

Note: If you’re someone who is loyal to a particular airline or a hotel group, a co-branded card is a smart way to cover most of your travel costs. But if you’re more of a budget-traveler, choosing whatever airline offers lower prices, then a general credit card is a better choice.

Tip – For a smoother ride, opt for the best seats on the plane. They provide better stability and ensure a more pleasant experience during your flight.

Best Co-Branded Travel Credit Cards

Because co-branded cards in travel are beneficial when you are loyal to a particular airline, MyTicketsToIndia thought it’ll be better to list co-branded travel cards, one major US airline at a time. References have been taken from The Points Guy and NerdWallet.

Best United Airlines Co-Branded Credit Cards

Listed below are the best travel cards issued by United Airlines that you can consider buying.

| CREDIT CARD | WELCOME BONUS | NOTABLE PERKS |

|---|---|---|

United Gateway Card | Earn 10,000 bonus travel miles after you spend $1,000 on purchases in the first 3 months your account is open. Annual Fee: $0 | 3x miles on grocery purchases (up to $1,500 in purchases per month) until Sept. 30, 2021; 2x miles at gas stations, on local transit, commuting, and United purchases; 1x miles per dollar elsewhere |

United Explorer Card | 40,000 bonus travel miles after you spend $2,000 on purchases in the first 3 months your account is open. Annual Fee: $95, waived the first year | 2x miles on restaurant, hotel, and United purchases; 1x miles per dollar elsewhere |

United Business Card | Earn 60,000 bonus travel miles after $3,000 in purchases within the first 3 months of account opening. Annual Fee: $99, waived the first year | 2x miles on United purchases, local transit and commuting, and at restaurants, gas stations, and office supply stores; 1x elsewhere |

United Club Infinite Card | $0 introductory annual fee for the first year, then $525 Annual Fee: $525, waived the first year | 4x miles on United purchases; 2x miles on all other travel and dining purchases; 1x miles elsewhere |

United Club Business Card | 50,000 travel miles after you spend $3,000 in the first three months after account opening. Annual Fee: $450 | 2x miles on United purchases; 1.5x miles per dollar elsewhere |

Best Delta Airlines Co-Branded Credit Cards

| CREDIT CARD | WELCOME BONUS | NOTABLE PERKS |

|---|---|---|

Delta SkyMiles® Gold American Express (AMEX travel card) | 35,000 bonus travel miles after you spend $1,000 in purchases on your new Card in your first three months. Annual Fee: $99, waived for the first year | First checked bag free on Delta flights; Medallion® Qualification Dollar (MQDs) waiver after spending $25,000 in a calendar year; 20% discount on inflight purchases |

Delta SkyMiles® Platinum American Express Card | 40,000 bonus travel miles and 5,000 Medallion® Qualification Miles (MQMs) after you spend $2,000 in purchases on your new card in your first 3 months. Plus, earn a $100 statement credit after you make a Delta purchase with your new Card within your first three months of account opening. Annual Fee: $250 | Earn 10k MQMs at $25,000 and $50,000 in calendar year spending (up to 20k per year); MQD waiver after spending $25,000 in a calendar year; a domestic main-cabin round-trip companion certificate each year upon card renewal; TSA PreCheck or Global Entry fee credit (up to $100); priority boarding; first checked bag free on Delta flights. |

Delta SkyMiles® Reserve American Express (AMEX travel card) | Earn 40,000 bonus miles after you spend $2,000 in purchases on your new card in the first three months of account opening. Annual Fee: $550 | Delta Sky Club membership; Centurion Lounge access; earn 15k MQMs at $30k, $60k, $90k, $120k in calendar spend; annual companion pass; complimentary upgrades for non-Medallions |

Delta SkyMiles® Gold Business American Express Card | Earn 40,000 bonus miles after you spend $2,000 in purchases on your new card in the first three months of account opening. Annual Fee: $99, waived for the first year | First checked bag free on Delta flights; MQD waiver after spending $25,000 in a calendar year; 20% discount on inflight purchases |

Delta SkyMiles® Platinum Business American Express Card | Earn 45,000 bonus miles and 5,000 Medallion® Qualification Miles (MQMs) after you spend $3,000 in purchases on your new card in the first three months. Plus, earn a $100 statement credit after your first Delta purchase on your new card in the first three months of account opening. Annual Fee: $250 | Earn 10k MQMs at $25,000 and $50,000 in calendar year spending (up to 20k per year); MQD waiver after spending $25,000 in a calendar year; TSA PreCheck or Global Entry fee credit (up to $100); priority boarding; first checked bag free on Delta flights; earn 1.5x miles on purchases over $5,000 (up to 50k miles). |

Delta SkyMiles® Reserve Business American Express Card | Earn 45,000 bonus miles and 10,000 Medallion® Qualification Miles (MQMs) after spending $4,000 on the card in the first three months. Annual Fee: $540 | Delta Sky Club membership; Centurion Lounge access; earn 15k MQMs at $30k, $60k, $90k, $120k in calendar spend; annual companion pass; complimentary upgrades for non-Medallions |

Best American Airlines Co-Branded Credit Cards

| CREDIT CARD | WELCOME BONUS | NOTABLE PERKS |

|---|---|---|

American Airlines AAdvantage MileUp Card | 10,000 American miles and a $50 statement credit after you spend $500 on purchases in the first three months of account opening. Annual Fee: $0 | 2 American miles for every $1 spent at grocery stores and on eligible American Airlines purchases, 1x elsewhere |

AAdvantage® Aviator® Red World Elite Mastercard® | 60,000 bonus miles and a $99 companion ticket awarded after you make a purchase within the first 90 days of card opening. Annual Fee: $99 | 2 American Airlines miles for every $1 spent on eligible American Airlines purchases, 1x elsewhere |

Citi / AAdvantage Platinum Select World Elite Mastercard | 50,000 miles after you spend $2,500 on purchases the first three months of account opening. Annual Fee: $99 (waived the first 12 months) | 2 American Airlines miles for every $1 spent at gas stations, restaurants, and on eligible American Airlines purchases, 1x elsewhere |

AAdvantage® Aviator® Business Mastercard | 65,000 miles after spending $1,000 in the first 90 days. Additional 10,000 miles when an employee card is used for purchase. Annual Fee: $95 | 2 American Airlines miles on eligible American Airlines purchases, office supply stores, telecom expenses, and car rentals, 1x elsewhere |

CitiBusiness® / AAdvantage® Platinum Select® Mastercard® | 65,000 American Airlines bonus miles after you spend $4,000 on purchases within the first four months of account opening. Annual Fee: $99 (waived the first 12 months) | 2 American Airlines miles for every $1 spent on eligible American Airlines purchases, telecom, cable, satellite, car rentals, and gas stations, 1x elsewhere |

Citi / AAdvantage Executive World Elite Mastercard | 50,000 miles after you spend $5,000 on purchases in the first three months of account opening. Annual Fee: $450 | 2 American Airlines miles for every $1 spent on eligible American Airlines purchases, 1x elsewhere |

Miscellaneous Co-Branded Travel Credit Cards

| CREDIT CARD | WELCOME BONUS | NOTABLE PERKS |

|---|---|---|

Alaska Airlines Visa Signature card | 30,000 bonus miles after you make $1,000 in new purchases. Annual Fee: $75 ($0 the first year) | It offers 3x miles for all Alaska purchases, and 1 mile per dollar spent elsewhere. Even though Alaska Airlines doesn’t fly to India, you can redeem your miles to fly there with several of their partners. Round-trip award flights to India on Air France or KLM are 80,000 miles in economy or 140,000 miles in business class. |

Southwest Rapid Rewards® Premier Credit Card | 6,000 travel points after your Cardmember anniversary each year. Annual Fee: $99 | Earn 2 points per $1 spent on Southwest® purchases. 1 point per $1 spent on all other purchases. No foreign transaction fees.No blackout dates or seat restrictions. Your points never expire, the benefit of the Rapid Rewards® program. |

Lufthansa Miles & More® World Elite MasterCard® | 50,000 miles Annual Fee: $89 | Earn 2 award miles per $1 spent on Miles & More ticket purchases. Besides, receive 2 complimentary Lufthansa Business Lounge Vouchers. |

British Airways Visa Signature® Card | 50,000 miles Annual Fee: $95 | Earn 5 Avios for every $1 spent British Airways, Aer Lingus, and Iberia flight purchases within the first 12 months from account opening, thereafter earn 3 Avios. Earn 3 Avios for every $1 spent on hotel accommodations within the first 12 months from account opening, thereafter earn 2 Avios. Earn 1 Avios for every $1 spent on all other purchases.* |

JetBlue Plus Card | Earn 50,000 travel points after spending $1,000 in the first 90 days and after paying the annual fee, plus an additional 50,000 travel points after spending a total of $6,000 on purchases within the first 12 months. That’s worth a whopping $1,300 based on The Points Guy valuations and is the best offer this card has seen. Earn 5,000 bonus points every year after your account anniversary. Annual Fee: $99 | Earn 6X points on eligible JetBlue purchases. 2X points at restaurants and eligible grocery stores and 1X points on all other purchases. Enjoy Mosaic benefits if you spend $50,000 or more on purchases each calendar year with your card2 Enjoy an annual $100 statement credit after purchasing a JetBlue Vacations package of $100 or more with your JetBlue Plus Card. 50% inflight savings on cocktails and food purchases. |

Pros Of Owning Co-Branded Travel Cards

- Free checked bag

- Free lounge passes

- Upgraded seats

- Reimbursement for federal traveler programs (like Global Entry)

- Better insurance offers

- Eligibility for travel accidents, travel delay, & lost luggage insurance for trips paid for on the credit card

- Inflight discounts

Cons Of Owning Co-Branded Travel Cards

- No flexibility – Restricted to one airline

- Can only be redeemed for flights

- Limited or no cashback offers

- Can’t transfer travel points or travel miles

- Can’t redeem points for a different airline (Exceptions Exist)

Things To Consider Before Buying Co-Branded Cards

1. Be Familiar With The Airline’s Alliance Partners

Before making your purchase for a co-branded card, make sure you’ve done your homework so you know what exactly can help you reap the maximum benefits out of it. What happens on most occasions is that you may get a credit card for a specific airline but want to use the miles on an airline alliance partner. Yes, it’s possible.

For example: If you have American Airlines cards, you can use the miles earned on these cards to book India flights from USA with Etihad and Qatar. You will have to let go of your ‘free checked baggage’ perk in this case but it’s a great move if you’re able to get the flexibility to book on a different airline because of its lower fares (for instance).

Hence, look for a card with a large airline alliance. Currently, United has the biggest alliance.

2. Understand The Rewards Program’s Restrictions

When buying a co-branded card, you must understand the rewards program’s restrictions to get the most out of it.

For example: Programs that have variable reward rates may work at their discretion and increase or decrease the value of miles for a particular time/month/season. Thus, keeping a vigil eye on this fluctuation can help you use your miles at a time that may boost them to 2x or 3x their value. How cool!

3. Verify The Point Expiry Policy

Now, most of you might be oblivious to this, but points expire in case there’s a lack of activity for 12 months. Do confirm this before finalizing your card.

Best General Travel Credit Cards

| CREDIT CARD | WELCOME BONUS | Best For |

|---|---|---|

Chase Sapphire Preferred Card | 60,000 bonus points. after you spend $4,000 on purchases in the first 3 months from account opening. Annual Fee: $95 | Best rewards credit card for travel (for beginners) |

The Platinum Card® from American Express | 75,000 Membership Rewards Points after you spend $5,000 on purchases in your first 6 months of card membership. Annual Fee: $550 | Best for the welcome offer |

Capital One Venture Rewards Credit Card | 60,000 bonus miles once you spend $3,000 on purchases within the first 3 months from account opening 1 Annual Fee: $95 | Best for earning miles |

Chase Sapphire Reserve | 50,000 bonus points after you spend $4,000 on purchases in the first 3 months from account opening. Annual Fee: $550 | Best for travel credits |

Capital One VentureOne Rewards Credit Card | 20,000 bonus miles once you spend $500 on purchases within the first 3 months from account opening 1 Annual Fee: $0 | Best travel credit card for no annual fee |

Pros Of Owning General Travel Cards

- Flexibility in redemption

- Not limited to one airline

- Earning on every spending

- Bumper introductory offers with points and cashback offers

Cons Of Owning General Travel Cards

- Foreign transaction fees

- High Annual fees

- No loyalty bonuses

Wrapping Up

That’s pretty much everything we had to share about the best credit card to book flights from USA to India travelers can use to initiate big savings.

If you happen to book cheap India flights from USA, we’ll gladly book you a flight at the best fares available. Get in touch with us either by giving us a call or by joining the live chat and we’ll make your flight booking process a hassle-free one.

If you happen to give us a call, you might end up getting up to $35 off your flight bookings. We have the best travel deals right now and you can avail of the same with ease.

See you on the other side of the call!

Frequently Asked Questions

Q: What kind of travel credit cards are there?

A:

There are two types of travel credit cards-

Co-branded travel credit cards

General-purpose travel credit cards

Q: Which are the most reliable websites for booking flights?

A: The best flight search engine websites are Expedia, MyTicketsToIndia, and Skyscanner.

Q: What card should I choose – co-branded or general?

A: It totally depends on your spending habits and travel goals. If you are loyal to a particular airline, go for a co-branded travel card. However, if you are more of a budget-traveler and want to fly with whatever airline that’s cheap, go for general credit cards.

Q: If you had to choose one, which one would you choose as the best rewards credit card for travel?

A: Chase Sapphire Preferred is our personal favorite and will vote as one of the best travel rewards credit cards.

Q: What is the best credit card for airline miles?

A: A co-branded card is the best miles credit card.

Q: Which bank credit card is best for travel?

A: Minneapolis-based U.S. Bank is one of the USA largest banks and also one of the biggest issuers of the best credit card for booking flights. Even though it is located primarily in the West and Midwest, any person can have the U.S. Bank credit card.

Q: Which is the best credit card for travel miles?

A: CitiBusiness® / AAdvantage® Platinum Select® Mastercard® is by far the best credit card for travel miles, considering all other deciding factors as well.

Q: Which is the best credit card for travel points?

A: Chase travel credit card – Chase Sapphire Preferred – is the best travel points credit card, taking into consideration other factors as well

About Heena Ganotra | View Posts

A writer by both passion and profession, Heena Ganotra is "half agony, half hope" but all heart. And oh, she has been a book lover from the start! Her love for books is what convinced her to make a career in the wonderful world of words. She loves what she does and is out-and-out a satisfied soul with a wish to spread happiness like herpes. Insight- Some say she is living the best life anyone could because she reads, writes, travels, and makes merry. They’re right because what else does one really need! :)

Latest Blog

-

Emirates Food Menu: Guide to In-Flight Dining on Emirates Airlines

Updated on 06 May 2025 -

Exploring American Airlines Low Fare Calendar Of 2025!

Updated on 06 May 2025 -

IPL Matches in Himachal Pradesh 2025 – Complete Schedule & Travel Deals

Updated on 08 May 2025 -

IPL 2025 Matches in Assam – Complete Schedule and Travel Details

Updated on 06 May 2025 -

IPL 2025 Matches in Andhra Pradesh – Complete Schedule and Travel Tips

Updated on 26 Mar 2025

Discuss this post ?